Your Risk Tolerance

Portfolio Profiles

Your Risk Tolerance Level: Not Available

It appears you have not completed the Risk Tolerance questionnaire. Fill in the questionnaire now to determine which Portfolio Profile is most appropriate for your financial situation.

| Score | Portfolio Profile |

|---|---|

| 0 | Guaranteed Investment Portfolio |

| 1 - 130 | Cautious with very low risk tolerance |

| 131 - 160 | Conservative with low risk tolerance |

| 161 - 190 | Moderate with average risk tolerance |

| 191 - 230 | Balanced with above average risk tolerance |

| 231 - 260 | Aggressive with high risk tolerance |

| Above 260 | Sophisticated with very high risk tolerance |

Guaranteed Investment Portfolio

Guaranteed Investments are the most appropriate solution for investors who are investing for a short period of time or for a specific period of time where the money is required at a known date in advance of investing. We generally advise clients to invest in a portfolio of staggered terms to ensure all investments are not coming due at the same time and therefore the client can take advantage of changes in interest rates on various terms over time. Investments typically include: T-bill accounts, money market instruments, Term deposits (cashable or locked-in terms) and short-term government bonds or investment funds with low volatility and low bond durations for safety.

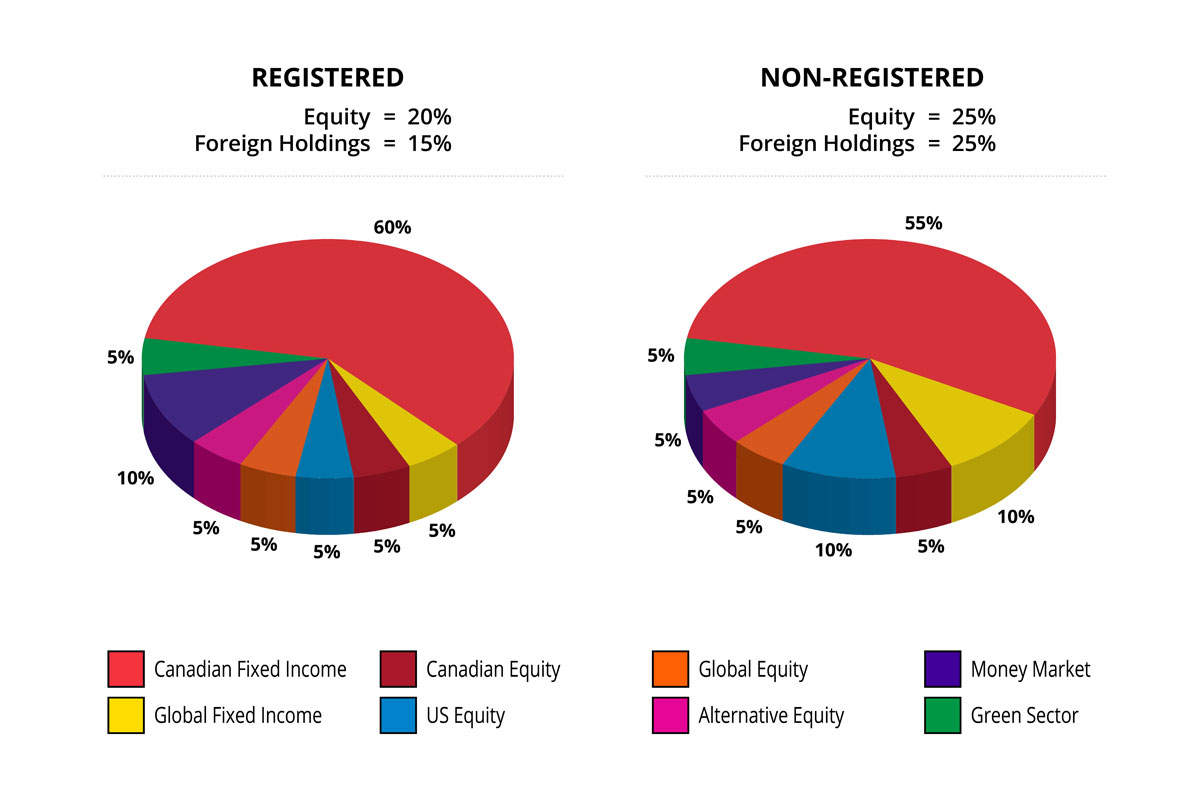

Cautious with very low risk tolerance

The Cautious Investor portfolio is the lowest risk option with a primary emphasis on income, capital preservation and safety. It is designed for investors who have a shorter-term investment horizon, want a regular income stream, and have concerns about investment volatility. A small equity component 20% for registered and 25% for non-registered investments is included to enhance returns above fixed income levels over the long-term.

Conservative with low risk tolerance

The Conservative Investor portfolio is a lower risk option focusing on income requirements and lower risk opportunities. It is designed for investors who have a shorter-term investment horizon, want a regular income stream, and have concerns about investment volatility. A small equity component 30% for registered and 36% for non-registered investments is included to strengthen investment performance above fixed income levels over the long-term.

Moderate with average risk tolerance

The Moderate Investor portfolio is designed for investors who have a medium-term investment horizon and prefer more income than growth. With 40% of the portfolio invested in equities for registered and 45% for non-registered portfolios, the investment risk is lower than more aggressive options but still provides some good opportunities for long-term growth.

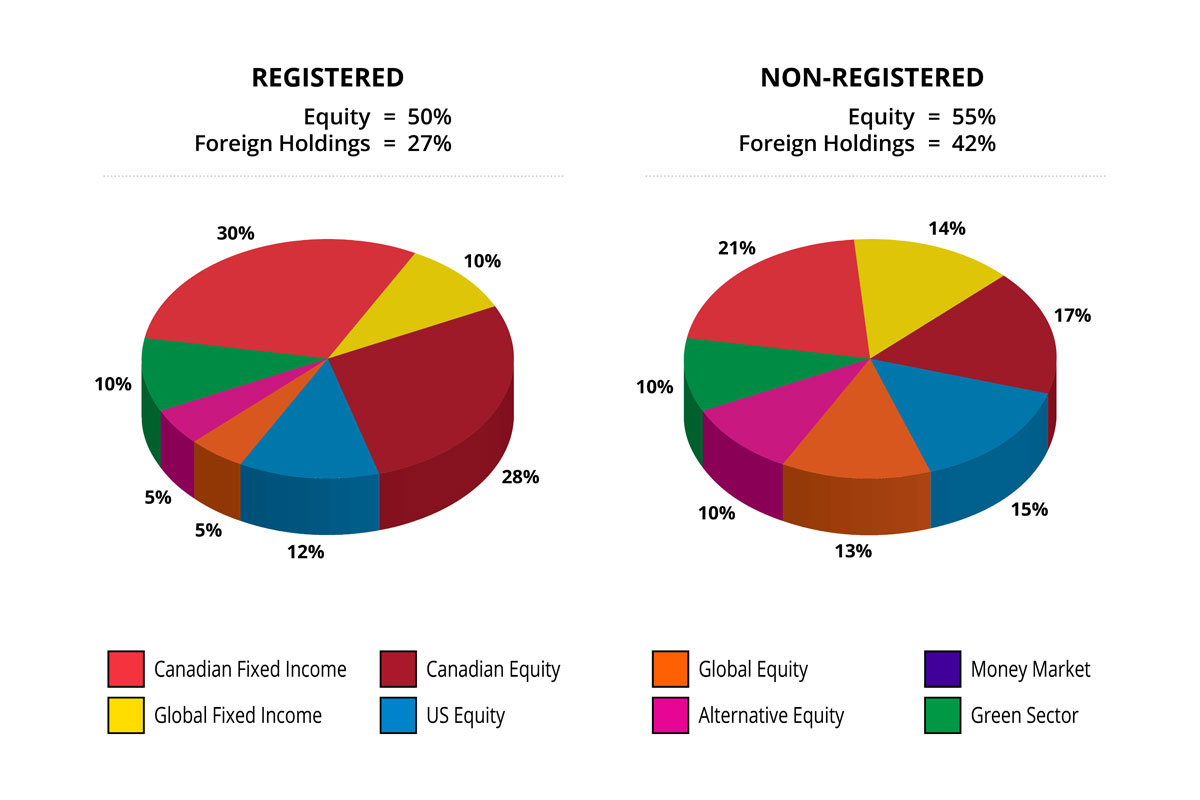

Balanced with above average risk tolerance

The Balanced portfolio is designed for those investors who want a balance between portfolio growth and income at slightly higher than average volatility levels. This portfolio consists of 55% in equities for registered accounts and 60% in non-registered accounts. This portfolio is appropriate for middle-of-the-road investors who are interested in long-term growth but recognize the need for some stable investments with reduced risk levels for personal comfort.

Aggressive with high risk tolerance

The Aggressive portfolio is designed to satisfy investors with a primary goal of long-term growth, but want some protection from income to stabilize serious portfolio volatility. This portfolio contains 75% equity investments for registered accounts, and 80% in equities for non-registered accounts. This blend is appropriate for investors who want some income in the short term but are more interested in long-term capital appreciation.

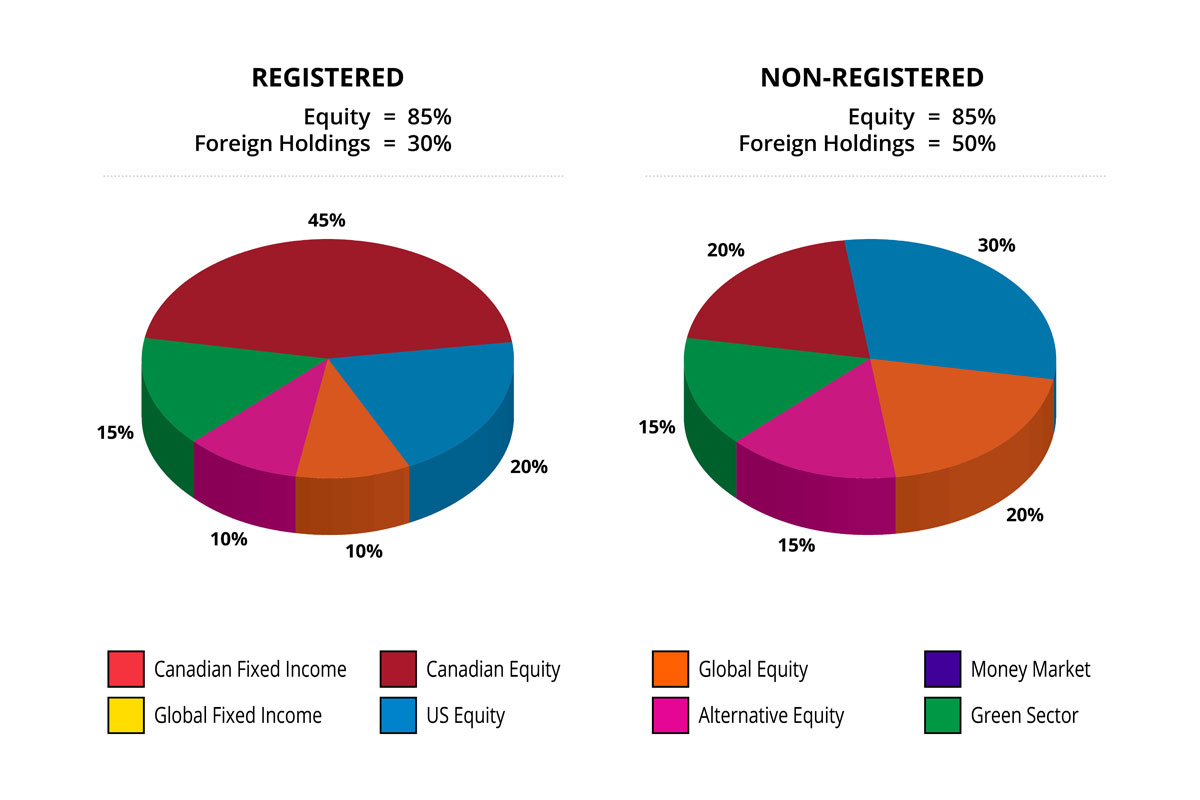

Sophisticated with very high risk tolerance

The Sophisticated Investor portfolio is designed for those who want the highest performance possible over the long-term and have no concerns about short-term investment volatility. The primary focus is to aggressively satisfy long-term accumulation needs. This portfolio consists solely of equity investments and is only appropriate for investors who understand the importance of developing a disciplined approach to investing for high long-term results.

Implementing Your Perfect Balance

Our Solutions utilize modern portfolio management techniques to maximize your portfolio returns and minimize your risk. “Perfect Balance” in your portfolio is achieved through proper diversification and by properly combining investments which have low correlations with each other.

Now that we have determined your proper asset types, the next step is to ensure your portfolio is properly diversified in the following areas:

- Country

- Canada, United States, Europe and other major markets in the world

- Asset Type

- Stocks, Bonds, Mortgages, Real Estate and Money market

- Asset Quality

- Preferred and Common Shares of companies, Small, Medium and Large Company stock, and various durations of government and corporate debt securities

- Sector

- Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Telecommunication Services, and Utilities represent some of the sectors you can invest in to diversify your portfolio

- Management Style

- Top-Down (focus on economic outlook), Bottom-up (focus on individual companies), Growth (focus on rapidly growing companies), Value (focus on companies currently under performing opposite their expected long-term value), and alternative styles of management.

By investing in a wide variety of assets and investment styles you reduce risk in your investment portfolio.