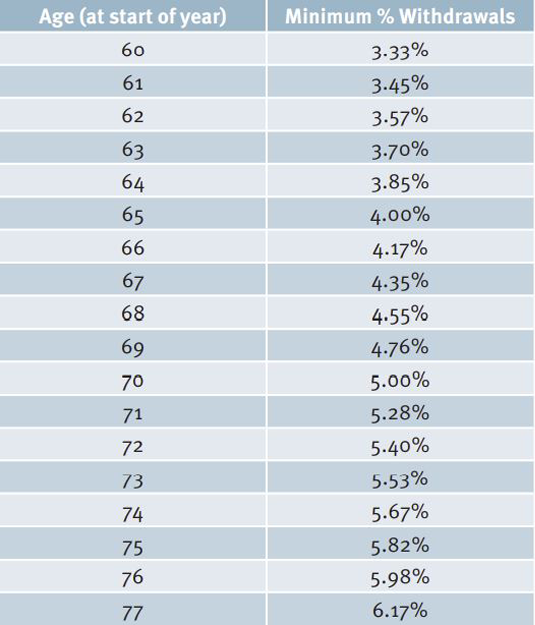

RRIF Withdrawals

To determine the required minimum RRIF withdrawal, a percentage factor corresponding to your age at the beginning of the year is applied to the value of your RRIF assets at December 31 of the previous year. When the RRIF is established, you also have the option to base the minimum withdrawals on your spouse or common-law partner’s age. Once you make this election, you cannot change it even if your spouse or common-law partner dies. However, you can establish a new RRIF, transfer funds from the old plan and make a new election for this new RRIF.

The chart below shows the minimum payment factors for 2015 and subsequent taxation years for ages 60 and older. The relevant age is either your age or your spouse’s age depending on what you elected when the RRIF was established.

Note that you will be required to receive at least an annual minimum payment from your RRIF. You can choose to receive this payment monthly, quarterly, semi-annually or annually, depending on your income requirements. If you do not require income you may decide to receive the annual minimum payment at the end of the year to maximize the tax-deferral benefits of your RRIF.

If you choose to receive the minimum amount from your RRIF, withholding tax will not apply to this payment if you are a resident of Canada. If you elect to receive a payment that exceeds the minimum payment, income tax will be withheld at source on the amount in excess of the minimum payment. The following table shows the percentage tax that is currently withheld when you make a single lump sum withdrawal: